It’s time to get hot and sweaty… and save some dollars

Welcome to a very special edition of The Integrated Masculine Man.

I’m going to kick this off with a confession: I’ve been really looking forward to publishing this post. I’ve heard people refer to The Barefoot Investor as a cult, and if that’s what it is, then I only wish I’d joined sooner. I consider myself very lucky to have some special people in my life who recommended this book to me quite some time ago.

By following the steps laid out below, I went from being a twenty-something with no savings, multiple black marks on my credit report, maxed-out credit cards, and no real financial direction, to a thirty-something single parent on a single income who owns their car outright, has no credit cards, has built up savings, has a strong share investment portfolio, just bought my second home, and enjoys the freedom to travel overseas at least once per year.

But before we dive in, a quick disclaimer: the information provided in this blog is for general informational purposes, based on my own personal experiences. It’s not intended as financial advice. I am not a licensed financial professional. Before making any financial decisions, please consult a qualified financial advisor, accountant, or another professional who can provide advice tailored to your unique situation.

For those unfamiliar with it, The Barefoot Investor is a best-selling book by Scott Pape that offers practical, straightforward advice on managing personal finances. It covers topics like budgeting, saving, investing, and retirement planning, all aimed at helping people achieve financial independence. If you’re looking for a get-rich-quick scheme, this isn’t the book for you. But if you’re looking for a set of simple, easy-to-follow steps that can put your finances on autopilot and gradually grow your wealth, then this is definitely the book for you.

While many of the book’s themes are tailored to an Australian audience, the core principles can be applied to most countries. At almost 300 pages, reading or listening to the audiobook should take the average person 7–9 hours to finish. My aim today is to give it to you in 40 minutes.

In this post, I’ll refer to Scott Pape as ‘Barefoot,’ a nod to his namesake, The Barefoot Investor.

So what is all the hype about?

In today’s world, we live in a society where literal trillions of dollars are spent on marketing. The primary goal of marketing is simple: get you (the consumer) to part with the change in your pocket. From ads to algorithms, from notifications to bus stops and billboards—everywhere you look, there’s a business peddling its wares.

Why, you ask? Because it works. The trillions spent on marketing, coupled with the science behind the dopamine hit consumers get from spending money, is proven. It doesn’t matter if it’s the latest smartphone, a sleek new pair of running shoes, or a perfectly spherical copper ball—if it’s being manufactured, someone will want to buy it.

The next key to success for these marketing companies? Financial education. Or, more accurately, the complete lack of it in our schooling systems. From how to do your taxes, to understanding superannuation, or even learning how to get the best value out of your hard-earned money—financial literacy is often overlooked.

The system is designed to keep people in the workforce, running on the proverbial treadmill: paying taxes, spending money, and working until the day they die.

This is where The Barefoot Investor comes in. It takes these complex subjects, makes them simple, and introduces easy-to-follow steps to put your finances on autopilot, edging you closer to financial independence.

The apple tree and the alpaca

Before we dive into the steps, there are two important underlying messages that Barefoot impresses upon his readers—messages that are crucial for successfully following the steps outlined in the book.

The first is the apple tree analogy. By committing to reading and acting on these steps, you’re essentially planting an apple tree today. You’ll plant the tree, water it occasionally, and make sure it doesn’t catch diseases and die. But you can’t expect to walk outside and find the tree towering over your yard, heavy with ripe apples, after just a few months.

In twelve months, you might find two or three small, underwhelming apples—but they won’t taste good. Years will pass, and one day you’ll step outside to find a thick, towering tree, full of apples, with strong roots and a trunk that will last for generations. The key message here is that by following the Barefoot steps, you’re not committing to a “get-rich-quick” scheme.

Barefoot divides his financial steps into Plant, Grow, and Harvest to reflect the natural journey of building wealth. In the Plant phase, you lay the groundwork—pay off debt, set up an emergency fund, and create systems for managing your money. The Grow phase is where you build wealth, invest for the future, and focus on long-term goals like retirement. Finally, in the Harvest phase, you enjoy the benefits of your hard work, with financial freedom, a comfortable lifestyle, and the ability to leave a legacy. It’s all about taking small, consistent steps to build a secure financial future over time.

The second message is about the Alpaca/Groundhog Attitude. Barefoot uses the term “Groundhog Attitude” to describe a mindset where people repeat the same behaviours day in and day out, yet complain that nothing ever changes. Groundhogs tend to make excuses for their financial situation—saying things like, “I don’t earn enough,” or “The cost of living is too high”—but they don’t take any action to improve their circumstances.

In contrast, Barefoot describes the Alpaca Attitude as a mindset of resilience and protection. He named it after his two alpacas, Pedro and Alberto, who are known for their headstrong and protective nature. These alpacas will spit, kick, and stomp to defend their flock from any threat.

In the context of personal finance, the Alpaca Attitude means being proactive and determined in protecting your financial well-being, just as the alpacas defend their flock. It’s about facing financial challenges head-on and taking decisive actions to secure your financial future.

So, knowing all this, are you ready to plant that apple tree and defend it with the same determination as your alpaca’s life depends on it? Because this is what it will take for these time-tested steps to take root and flourish—not just for you, but for future generations!

The Barefoot Steps

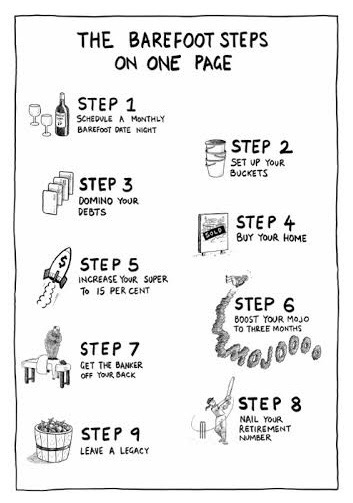

Here’s a brief overview of each step:

- Schedule a Monthly Barefoot Date Night: Set aside a specific time each month to sit down with your partner (or by yourself) and review your finances. This helps you stay on track and make informed decisions about your money.

- Set Up Your Buckets:

Divide your income into three buckets: Blow, Mojo, and Grow.

Blow: For daily expenses and fun.

Mojo: An emergency fund to cover unexpected expenses.

Grow: For long-term savings and investments. - Domino Your Debts: List all your debts from smallest to largest. Focus on paying off the smallest debt first while making minimum payments on the others. Once the smallest debt is cleared, move to the next one. This creates a momentum to clear all debts.

- Buy Your Home: Save for a home deposit using a sensible plan. Aim for a 20% deposit to avoid paying Lenders Mortgage Insurance (LMI). Make sure your budget can comfortably accommodate the mortgage repayments.

- Increase Your Super to 15%: Boost your superannuation contributions to 15% of your income. This helps ensure you have enough savings for a comfortable retirement. You can do this through salary sacrifice or personal contributions.

- Boost Your Mojo to Three Months: Build an emergency fund that covers three months of living expenses. This provides a financial safety net in case of unexpected events like job loss or medical emergencies.

- Get the Banker Off Your Back: Focus on paying down your mortgage. Make extra repayments whenever possible to reduce both the principal and interest over time. This helps you own your home outright sooner.

- Nail Your Retirement Number: Calculate how much money you need to retire comfortably. Consider factors like your desired lifestyle, expected expenses, and life expectancy. Use this number to guide your savings and investment strategy.

- Leave a Legacy: Plan how you want to make a positive impact on the world. This could involve charitable giving, supporting causes you care about, or leaving an inheritance for your loved ones.

Now that you’ve got an overview, let’s dive a little deeper into each step. I’ll share the nuggets of wisdom that resonated with me the most and how they’ve helped me personally.

Step 1: Schedule a Barefoot date night

A Barefoot Date Night is essentially an opportunity to set aside dedicated time to review your finances. Barefoot recommends scheduling a date night once a week. After the first five weeks, switch to monthly date nights for the rest of your life.

This time is all about treating yourself (and/or your significant other) while also keeping on top of managing your money. It helps establish a habit of financial responsibility while rewarding you for doing so.

If you’re in a partnership, this is a great opportunity to show your partner that saving money doesn’t mean depriving yourself—sometimes it means treating yourself to a nice night out. If, like me, you’re in a sacredly single era, take yourself out or, better yet, take a non-Barefoot friend along and introduce them to the concept!

Your bank is a billion-dollar business, not just a money vault

In the first Barefoot Date Night, Barefoot encourages you to review your bank’s annual fees, interest rates, and overall value. He suggests switching to a bank with low (or ideally no) monthly or annual fees.

“It doesn’t pay to be loyal. What you need is a dead-simple, zero-fee solution.” – Scott Pape

In my own case, I was banking with National Australia Bank (NAB), which charged me a monthly fee for my Everyday account, as well as a separate fee for internet banking. I switched to ING, which has no monthly fees, no internet banking fees, and no ATM fees. The result? I saved around $400 a year.

It may not sound like much, but if you have multiple accounts, or an overdraft limit (especially if you’re not even using it!), think about the total fees you’re paying. Those small charges add up over time; they’re a perfect place to cut unnecessary costs.

Is your Superannuation growing your wealth, or the fund managers?

For Barefoot Date Night two, Barefoot encourages us to take a look at our superannuation—something most people don’t start thinking about until they’re nearing retirement.

Here are the key points to consider when reviewing your superannuation:

- Consolidation: An alarming number of Australians have more than one super fund. This often happens because, over the course of their careers, people start new jobs and, instead of choosing their own super fund, they accept whatever fund their employer sets up. Each extra super fund eats away at your retirement savings through unnecessary annual fees. Consolidating your accounts can help stop this drain on your finances. The good news is, consolidating your super into one fund is as simple as logging into your MyGov account and using their online portal.

- Choosing a low-cost fund: In the book, Barefoot points out that AMP is one of the largest super funds in Australia, but despite its size, it has some of the highest fees, and its performance doesn’t outperform most other funds. This shows that bigger isn’t always better—sometimes, the best value is found in a low-cost fund with good performance.

- Investment options: Ask yourself this: where is your current super fund investing your money? I’ll wager most people don’t know the answer. Unless you specify otherwise, most super funds will place your money in the default “balanced” investment option. Take a moment to consider your risk tolerance and retirement goals, and choose an investment option that aligns with those objectives. A diversified portfolio can also help you manage risk and maximize growth.

- Regular reviews: Barefoot also stresses the importance of regularly reviewing your super. Just like any other financial asset, your superannuation needs to be regularly checked to ensure it is performing well. Don’t just set it and forget it—your retirement security depends on it!

It’s also worth noting that if you work in a sector that provides critical services to the community—such as education, health, or emergency response—you may have access to private super funds that offer better benefits and lower fees. Always consider the options available to you and tailor your choice to your specific situation.

To really illustrate how important this step is, let me use my own situation as an example. I work 100 hours a fortnight. As of July 1st this year, the Employer Superannuation Guarantee (SG) requires my employer to contribute 12% of my Ordinary Time Earnings (OTE) per pay period. This is equivalent to around 12 hours of pay every fortnight and about 312 hours per year.

I want to make sure that I’m getting the best return on investment over the course of my working life, while minimizing unnecessary fees. After all, when I retire, I don’t want my contributions to have been eaten up by super fund managers who drive luxury cars while I’ve been grinding away for years!

Why wait? Spend a few minutes logging into MyGov today and start consolidating your super—it could make a big difference to your retirement.

Protecting yourself from financial doom, not just from rainy days

For Barefoot Date Night three, it’s time to review our insurances and ask ourselves two key questions: 1) Do we need it? and 2) Are we getting the best value?

Barefoot outlines his “Golden Rules of Insurance,” which are essential for making sure you’re not over-insured or under-covered:

- Only insure against things that can kill you financially: Focus on insuring against major risks—like your house burning down, serious illness, or being unable to work. Avoid insuring smaller items, like your mobile phone or electronics with extended warranties. For items like bicycles or jewellery, it’s usually more cost-effective to include them in your home and contents insurance.

- Choose a higher excess: Opt for a higher excess (the amount you pay out-of-pocket when making a claim) to reduce your premiums. This is more manageable if you have an emergency fund (your Mojo) to cover the excess—something you’ll be building if you’re following the Barefoot steps!

- Don’t automatically renew your insurance: Insurance companies often offer better deals to new customers. Shop around each year to ensure you’re getting the best rate and coverage. If a quick online comparison shows cheaper rates for the same service, call your current provider and let them know you’re considering switching. More often than not, they’ll match or beat the competitors’ prices to keep you as a customer!

The next step is to check your excess. If your car insurance excess is set to $250, ask your provider for a quote with a higher excess—say, $500 or even $750. This simple adjustment can lower your premiums, but insurance providers won’t always volunteer this information because they earn commission based on how much you pay.

Finally, don’t forget to run market comparisons. Get quotes from different insurance providers with the same details, and then reach out to your current insurer. If they can’t match or beat a competitor’s quote, don’t hesitate to switch!

Do you actually need private health insurance?

Barefoot emphasises that Australia’s public healthcare system (Medicare) provides free or low-cost care for most essential medical services. In fact, it’s one of the best healthcare systems in the world. For many, especially those who are generally healthy and don’t require frequent medical attention, private health insurance could be an unnecessary expense.

That said, if your individual income exceeds $93,000 or your combined income is over $186,000, the Australian government will impose a Medicare Levy Surcharge—an additional tax for individuals who don’t have private health insurance. If you’re in this income bracket, paying for private health insurance often works out to cost roughly the same as the surcharge. In return, you gain access to private hospitals, shorter wait times, a choice of doctors and specialists, and generally more comfort and privacy than the public system provides.

Barefoot also has some golden rules when it comes to getting better private health insurance for less than you are paying now:

- Purchase top-level comprehensive private hospital insurance: Get the best hospital cover you can for your money.

- Avoid extras or combined healthcare cover: If you need a healthcare service not covered by your insurance, pay for it with your fire extinguisher (emergency fund). Extras can cost you hundreds of dollars per year, whether you claim or not.

- Stay away from iSelect: iSelect is one of Australia’s most visited health “insurance comparison sites,” but it’s essentially a sales page. Of the 35 healthcare providers available, iSelect only lets you choose from 12.

Do you really need extras like dental?

Do you have dental coverage on your private health insurance just to get your teeth cleaned every six months? Unless you’re living in the United States (which has some of the highest dental fees in the world), consider whether it’s cheaper to pay for dental visits out-of-pocket. Often, dental extras on private health insurance may not be the most cost-effective way to cover basic dental care.

If you have additional extras on your private health insurance, get in touch with your provider and request your Claims History Statement. Take the time to review what you’ve claimed and calculate how much you’ve spent on those extras over the past year. You might be surprised at how little value you’re actually getting from these add-ons, and whether it would be more economical to pay as you go.

Do NOT skip this part

So far, you’ve protected your assets and your health—now it’s time to protect the ones you love.

If you’ve got a family, one of your most crucial roles is your ability to provide for them. Yet, shockingly, in Australia, statistics show that if you don’t have Income Protection Insurance, you’re in the majority.

Income Protection Insurance is designed to support you financially if you’re unable to work due to injury, illness, or disability. It typically replaces 75-85% of your income for a specified period, helping you maintain your lifestyle and cover essential expenses while you’re unable to earn. In short, it’s the safety net that ensures you and your loved ones aren’t left in financial jeopardy if something happens to you.

The other two critical life insurances are Total Permanent Disability (TPD) and Life Insurance (Life Cover):

- TPD Insurance: Provides a lump sum if you become totally and permanently disabled and are unable to work—whether in your usual occupation or any occupation, depending on your cover.

- Life Insurance: Offers a lump sum payment to your beneficiaries (usually family members or dependents) if you pass away unexpectedly. It ensures that your loved ones are financially protected during a time of grief.

The good news is that if you have Superannuation, you’re likely already covered for TPD and Life Insurance. The bad news? If you’ve never reviewed it, your cover is probably set to the default amounts—often the bare minimum, which may not provide adequate protection.

What you need to do now:

Call your super fund: Reach out to your super fund and ask them for a quote for the following:

- Income Protection Insurance: Covering 75% of your wage until you’re 65 years old.

- TPD & Life Insurance: Covering 10-12 times your annual salary (do the math before you call them!).

- Additional Contributions: Find out how much extra you need to contribute per pay period to cover the additional insurance costs (so that your regular super contributions aren’t eaten up).

It might sound like a lot, but you’ll probably be surprised by how affordable it is. For example, I increased my TPD and Life cover from $120,000 to $1,000,000, and my extra super contributions per pay period are less than $60.

That’s a sacrifice I’m more than happy to make, knowing that if I’m struck by some unforeseen accident tomorrow, my family won’t be left to struggle financially.

Are you low or high maintenance?

The first three Barefoot date nights took us through the big-ticket items—the ones that often go years without a second thought. But date night number four is where we dive into the nitty-gritty of our expenses. What does it actually cost to be us? What are our household expenses? This is where Barefoot introduces the concept of becoming a conscious spender.

A conscious spender is someone who spends money thoughtfully and intentionally, with a clear understanding of their financial priorities, values, and goals. Instead of making impulsive or reactive purchases, a conscious spender makes choices that align with their long-term objectives and personal values. This approach blends mindfulness with financial discipline, meaning the money you spend genuinely enhances your life and adds lasting value.

Barefoot shares a powerful story from his own life to illustrate this. After a devastating bushfire tore through his family home, destroying not just the house but also years of memories and possessions, he and his family found themselves with a hefty insurance payout. Instead of succumbing to the temptation of retail therapy, buying back everything they lost, Barefoot and his family waited twelve months before purchasing anything. This time gave them the perspective to decide what was truly needed to replace, and what could be let go.

His experience drives home a key point:

“You buy things you don’t need, with money you don’t have, to impress people you don’t like, with a lifestyle you can’t afford. And the worst part is, most of those people won’t even be in your life in 20 years.“

Instead of mindlessly buying things just for the sake of it, Barefoot encourages us to spend more on things that genuinely improve our quality of life. For him, the first thing he bought after the fire was a Dunlopillo pillow—expensive, yes, but highly rated for comfort and something that would bring genuine value to his life. (And I’ve followed his lead, recently replacing my own pillow when I found it on sale—half price, no less!)

In my own life, I’ve embraced the “living like a millionaire” mentality when making purchasing decisions. For example, I was going through a new pair of shoes every year at work. These weren’t safety-standard shoes (so not mandatory), just the $200 pairs I’d buy from Myer. But when the most recent pair started to fall apart, I decided to invest in something more durable: a pair of RM Williams shoes—well-known for their quality and longevity. Sure, they were three times the price of my usual pair, but the difference in quality is undeniable. These shoes come with a lifetime warranty, and after a few years of wearing them every workday, they’re still going strong. In the long run, this one purchase has saved me money because I won’t need to replace them for many years to come.

Step 2: Set up your buckets

“If you can’t explain your plan in thirty seconds… then you don’t have a plan.” – Scott Pape

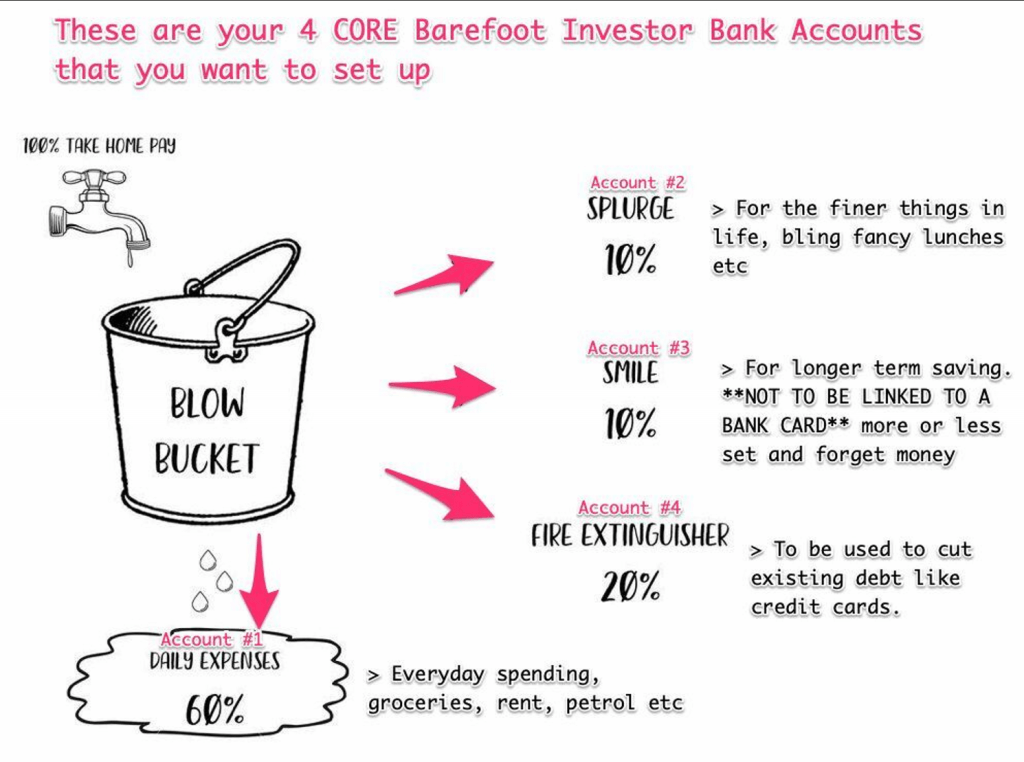

This is arguably one of the most critical steps in the whole Barefoot process. The idea here is to simplify your financial management by dividing your income into three ‘buckets’. This system helps you balance your spending, save for emergencies, and invest for the future without overwhelm. Here’s how it works:

How to set up your buckets

- Blow bucket: This is your everyday spending. Your Blow Bucket covers all of your regular expenses—groceries, bills, entertainment, dining out, subscriptions, and anything else that forms part of your day-to-day living. The goal here is to set aside enough for your daily needs while still keeping within your limits, so you avoid overspending.

- Mojo bucket: Your Mojo Bucket is your emergency fund. This is money set aside for the unexpected: medical bills, car repairs, a job loss, or any other surprise expenses. Barefoot recommends building your Mojo fund to cover at least three months’ worth of living expenses. With this financial cushion, you’ll feel much more at ease knowing you’re prepared for life’s curveballs.

- Grow bucket: The Grow Bucket is your long-term savings and investments. This is where you allocate money for future goals: saving for a house, contributing to your superannuation, or building wealth through other investment avenues. The Grow Bucket is all about setting yourself up for the future and watching your wealth grow over time.

How to set up your buckets

- Calculate Your Income: Start with your net income—the total amount you take home after taxes (whether it’s fortnightly, monthly, or whatever your pay frequency may be). This is the “cash in hand” that you’ll divide into the three buckets.

- Allocate Your Income: Now, divide this income into the three buckets. While Barefoot suggests the 60/20/20 rule (60% to the Blow Bucket, 20% to Mojo, 20% to Grow), it’s essential to adjust these percentages based on your unique circumstances. If you’re in the early stages of building an emergency fund, you might want to allocate a larger portion to the Mojo Bucket until you’ve reached your target.

- Automate the Process: The magic happens when you set up automatic transfers to each of these buckets as soon as you get paid. This step makes managing your money effortless. Automating the transfers ensures that your savings and investments grow consistently, and you’re less likely to dip into funds that are meant for something else.

By putting your financial plan on autopilot, you eliminate the need for constant manual tracking or willpower. The beauty of this system is that once it’s set up, it practically runs itself. Your money will go where it’s needed without you having to think about it, and over time, you’ll find yourself building wealth and protecting your future without stress.

Step 3: Domino your debts

In this step, Barefoot introduces his domino strategy, a simple yet powerful approach to paying off debts systematically. Start by listing them from smallest to largest, including interest rates, and consider negotiating better rates with your lender or switching to one offering lower fees.

Barefoot’s “domino” method breaks this down into five steps:

- Calculate: List all debts, including credit cards and loans, to know exactly what you’re dealing with.

- Negotiate: Call your lender and try to negotiate a lower interest rate. If they’re uncooperative, mention better deals from other banks.

- Eliminate: Cut up your credit cards as a symbolic step to free yourself from debt.

- Detonate: Focus on paying off your smallest debt first. As you knock them out, you’ll gain momentum.

- Celebrate: Celebrate each win, no matter how small, to stay motivated and keep progressing.

Barefoot especially emphasises tackling high-interest debts—like credit cards—as quickly as possible. These debts are the most expensive, often growing faster than you can pay them off. By eliminating them, you not only stop the bleeding but also make your money work for you, instead of against you.

The beauty of the domino method is that it helps you gain psychological wins as each debt is paid off. It’s not just about the numbers on paper; it’s about building confidence and motivation. Clearing one debt gives you the momentum to tackle the next, which in turn propels you forward until all your debts are gone.

Debt is slavery

If you have credit card debt, personal loans, or a car loan, Barefoot argues you’re not truly free. Debt controls every aspect of your life, from what you wear, to where you work, to how you spend your weekends.

Debt creates a sense of constant pressure, a heavy weight that makes you feel like you’re stuck. It defines what’s possible for you in the present and the future. It impacts your self-esteem, your dreams, and your potential. It eats away at your financial and emotional well-being.

Barefoot stresses that credit card debt is unnecessary. Many Australians find themselves trapped by credit cards, often because of a deeply ingrained belief in the culture of credit. From a young age, institutions and advertising teach us that “credit” is the path to success, but in reality, it’s just another form of debt slavery.

Credit cards are marketed as a tool for financial freedom, but in practice, they often keep us stuck in a cycle of minimum payments and interest. Most Australians have one or multiple credit cards—sometimes without even realising how much they’re costing them in the long run.

By tackling your debts systematically, you break the chains of debt and start to gain control over your money. Each debt paid off creates momentum and reduces financial stress, ultimately bringing you closer to financial freedom.

Following this approach not only relieves immediate financial pressure but sets you on a path towards creating a debt-free life. Once your debts are gone, you can direct your energy toward the things that truly matter, like building your wealth, securing your future, and living life on your own terms.

It’s not just about eliminating the weight of debt. It’s about regaining your power, confidence, and freedom to create the life you want.

Step 4: Buy your home

In this chapter, Barefoot dives deep into everything you need to know about buying your first home—and offers valuable insights for those considering purchasing a second or third home as well. If only I had this knowledge when I bought my first home!

If you’ve been following the Barefoot steps so far, you’ll have tackled your debts with the “fire extinguisher” in Step 3. Now, it’s time to turn that extinguisher on your home deposit. This step is about getting serious about saving for your 20% deposit, and visualising your progress.

The first and most important goal is to save for a 20% deposit. Barefoot emphasises that this is a game changer, as it helps you avoid Lenders Mortgage Insurance (LMI)—an insurance policy that you must take out if your deposit is less than 20%.

LMI is a financial burden, as it doesn’t protect you; it only protects the lender. The other critical aspect of saving 20% is that it’s not just about avoiding insurance—it’s about proving to yourself that you can do this. It’s a huge confidence boost when you finally have the deposit saved.

Common mistakes to avoid

Barefoot identifies five key mistakes that first home buyers often make:

- Waiting for a market crash: The market rarely crashes in the way we expect. By the time it does, you might have missed your chance to buy.

- Buying a home they can’t afford: Don’t stretch your budget to the limit. The best mortgage is one that leaves room for a comfortable life.

- Buying an investment property first: Buying an investment property before your own home delays your ability to get into the market.

- Renting but forgetting to save: If you’re renting, make sure you’re putting money aside each month for your deposit. Don’t let renting become an excuse not to save.

- Not considering other options: There are more ways to get into the market than you think—don’t limit your options.

How to do it right

Here’s the winning formula for buying your first home:

- Save Like CRAZY: This is the foundation. Set up sustainable saving targets that will keep you motivated in the long term, not just for the deposit. The key is to live below your means and set aside a portion of your income for your home fund.

- Remember: Your goal is to be able to comfortably live with your mortgage repayments after you buy the home. Buying your first home isn’t just about the deposit; it’s about affording the ongoing costs too.

Barefoot’s golden rule for real estate? It’s not location, location, location. It’s safety, safety, safety. Your home should provide you with stability and comfort, so don’t compromise on the essentials.

Here are the most common questions Barefoot gets asked by first home buyers;

How much can I afford? Always borrow less than the bank is willing to lend you. Generally payments should be no more than 30% of your take-home pay, and if you’re planning on starting a family soon, factor in a potential drop in income and an increase in costs.

How can I drastically cut my rent while saving for a house deposit? Downsize. Moving to a cheaper suburb or smaller house temporarily can make a huge difference in your ability to save quickly for your deposit.

Should I buy an investment property first? Not unless you plan on moving into it. What most people don’t realise is that investment properties consume your savings, and delay your ability to buy your own home.

Should I wait for the house market to crash? No. If you have your deposit saved, and you plan to live in the property for at least 10 years, now is a good time to buy, no matter the state of the market.

Should I buy with friends or family? Friends? Absolutely not. How many long term share house friendships do you see? Family? Possibly. As long as you’re planning to live in it for the next ten years.

Should I get my parents to go guarantor? No way. This can create huge risks for both you and your parents. Always look for a more sustainable solution.

What about government grants? As a first home buyer, you’re often eligible for government grants or stamp duty concessions. Your bank will help you apply for these, but for more info, visit firsthome.gov.au.

Barefoot also recommends seeking out a cashback mortgage broker, if possible. Unlike traditional brokers, a cashback mortgage broker may charge an upfront fee, but they redirect the bank’s trail commission back into your mortgage, helping to pay down your balance faster!

Barefoot’s approach to buying a home is not just about saving for a deposit—it’s about taking a strategic, long-term view on what you can truly afford. By saving diligently and making thoughtful decisions, you’ll not only buy your dream home but create a foundation for financial stability for years to come.

Step 5: Increase your Super to 15%

In this step, we’re focusing on long-term planning, specifically superannuation (or “super”) and how to leverage it to build wealth and financial security. Barefoot emphasises the importance of having a solid super strategy, especially as many people approach retirement with insufficient super savings. It’s crucial to start early and be intentional with your contributions, rather than leaving your retirement to chance.

Super is one of the most powerful wealth-building tools available to Australians due to its tax advantages. Barefoot recommends aiming for 15% of your income to be contributed to your superannuation. This is a balanced approach that allows you to benefit from compound interest while still having money available for other financial goals in the short and medium term.

If your employer already contributes 10.5% to your super (or whatever the current employer contribution rate is), you should aim to personally contribute the remaining 4.5% to reach a total of 15%.

The goal is simple: ensure your super is growing consistently so that by the time you’re ready to retire, you have enough to support your lifestyle. It’s about setting it and forgetting it, putting your contributions on autopilot so you don’t need to actively worry about it.

Barefoot finally talks investing

I’m going to briefly cover the key points of the investing side of this, as I plan to deep dive into the world of investing and more importantly, how I invest in a later entry of The Integrated Masculine Man.

While Barefoot acknowledges that investing might seem intimidating at first, the hardest part is just getting started. Once you begin, your money starts working for you—making it one of the best ways to build wealth over time.

Barefoot then dives into one of the most critical concepts for long-term wealth building: compound interest.

- What is Compound Interest? Compound interest is the concept where you earn interest on your interest, allowing your wealth to snowball over time. The longer you let it compound, the more your money grows exponentially.

- A Simple Example of Compound Interest: Imagine you invest $1,000 at a 5% interest rate, compounded annually, for 3 years:

○ Year 1: You earn 5% of $1,000 = $50. Your total is now $1,050.

○ Year 2: You earn 5% of $1,050 = $52.50. Your total is now $1,102.50.

○ Year 3: You earn 5% of $1,102.50 = $55.13. Your total is now $1,157.63.

○ By Year 30, that original $1,000 investment will have grown to $4,321.

The key takeaway is that compound interest works best the longer you allow your money to grow. This is why it’s so important to start early.

Here’s everything you need to know about investing:

How do I buy shares? If you’re using your super for investing, you can use an SMSF Lite (a simpler version of a Self-Managed Super Fund). If you’re investing outside of your super, you can contact your bank to use their share trading platform. There are also several apps like Pearler or Raiz that make investing in shares simple and accessible.

What is an SMSF Lite? An SMSF Lite is a streamlined version of a Self-Managed Super Fund (SMSF). It gives you more control over your super investments but without the complexity and high costs of a traditional SMSF. It’s a great option if you want the benefits of an SMSF but without the administrative burden.

How do I open an SMSF Lite? To open an SMSF Lite, contact your super fund to see if they offer this service. Be aware that most industry or retail super funds won’t provide SMSF Lite services, so you may need to explore other providers that specialize in this type of account.

Are shares the same as stocks? Yes, shares and stocks are the same thing. They are often referred to as equities as well.

How do I know if I own the shares? When you buy shares, you’ll receive a Holding Statement (typically via mail), which shows your ownership. The holding is registered to your broker, which can be your bank or share trading app.

What are dividends? Dividends are simply a business sharing it profits with their shareholders, typically twice a year. If your shares offer a Dividend Reinvestment Plan (DRP), you can choose to have the dividends automatically reinvested into your portfolio, helping it grow even more.

When should I buy, and when should I sell? Buy shares when you have the money and sell shares when you need the money (hopefully decades later when you’re comfortably retired). Don’t fall into the trap of day trading or obsessing over daily market fluctuations. Stay focused on the long-term growth.

Should I invest in shares or pay off the mortgage? Barefoot suggests doing both. Making extra repayments on your mortgage provides a guaranteed return, while investing in shares allows you to benefit from long-term growth. The key is balance.

Increasing your super to 15% is a key part of ensuring that you’re building long-term wealth. Barefoot’s approach helps you to automate your super contributions and make your money work for you over time.

Through the power of compound interest and investing in shares, you can build a comfortable nest egg for retirement that allows you to live the life you want, without relying solely on the government or a pension.

By following these principles, you’re setting yourself up for financial independence and ensuring that your retirement years are as comfortable and stress-free as possible.

Step 6: Boost your Mojo to three months

For this step, Barefoot advises readers to take your fire extinguisher, and point it at that Mojo account you set up in step one. The Mojo account is essentially your emergency fund, and you’re going to keep the fire extinguisher focused on it until you’ve got roughly three months’ worth of living expenses in it. To calculate how much you need to put in—it’s roughly whatever you’re putting into your blow account per month, multiplied by three.

The goal is to create a financial buffer that can cover unexpected expenses, like job loss, medical bills, or major repairs, without relying on credit or loans. Barefoot recommends setting up automatic transfers aligned with your pay schedule to put this on autopilot—set and forget!

The goal here is to have peace of mind and financial stability, knowing that you’re prepared for life’s inevitable surprises. Once you have this three month buffer in place, you’ll have more security and confidence in managing your finances.

Step 7: Get the banker off your back

In step 7, we now focus on bringing that mortgage balance down in any way possible. Making extra repayments- especially on the principal amount, to reduce the overall loan term and interest paid.

Barefoot suggests setting up automatic extra repayments (even small amounts) to chip away at the mortgage which will have a significant long-term impact.

By paying off your mortgage sooner, you’ll free up money for other financial goals, reduce the stress of long-term debt, and ultimately save on interest. Barefoot emphasises the power of consistency and urges us to make the most of any windfalls (such as tax returns or bonuses) by putting them towards the mortgage.

Here’s a simple example of how a minor extra repayment can impact a 30-year mortgage:

Loan amount: $400,000

Interest rate: 5% per year

Loan Term: 30 years

Monthly repayment: $2,147

With an additional $100 repayment per month

Monthly repayment: $2,247

Loan Term: 26 years and 6 months

So by making an additional $100 payment per month, the loan term is reduced by roughly 3.5 years, and you save an additional $101,620 in interest not paid.

Barefoot’s advice is clear: paying off your mortgage faster can save you substantial amounts of money and reduce the stress of long-term debt. By making extra repayments—no matter how small—and using windfalls to pay down the loan, you can cut years off your mortgage and save tens of thousands in interest.

Consistency is key, so automate your repayments, stay disciplined, and you’ll be well on your way to a debt-free life!

Step 8: Nail your retirement number

You’ve made it this far—well done! You’ve worked through budgeting, building your safety net, paying down debt, and setting yourself up for financial stability. Now it’s time to shift gears and start thinking about the next phase of life: retirement.

In Step 8, Barefoot focuses on one of the most important financial goals you can set: determining your retirement number—the amount of money you’ll need to live comfortably when you stop working.

Your retirement number is the amount of money you’ll need to retire comfortably. This number depends on several key factors:

- Desired Lifestyle: What do you want your life to look like in retirement? Do you plan to travel extensively, pursue hobbies, or live more modestly? The more active your lifestyle, the more money you’ll need.

- Retirement Duration: The earlier you retire, the longer your money will need to last. If you plan to retire at 60 and live until 90, you’ll need enough funds to support you for 30 years or more. Factor in your expected life expectancy.

- Current Expenses vs. Retirement Expenses: Consider how your expenses will change in retirement. Will you be spending more on healthcare? Will you have fewer work-related costs (e.g., commuting)? Or will your travel and leisure activities increase your spending?

- Government Support and Pensions: Don’t forget to take into account any government support you might receive, such as the Age Pension in Australia, and how this will supplement your retirement savings.

How to calculate your retirement number:

- Determine your desired retirement income: How much do you want to live on each year during retirement? A common recommendation is that you’ll need around 70-80% of your current income in retirement, but this varies greatly depending on your lifestyle goals.

- Calculate the total needed: Once you have an idea of how much income you’ll need per year, multiply this by the number of years you expect to be retired. For example, if you want $50,000 a year for 30 years of retirement, you’d need $1.5 million.

- Consider other income sources: Take into account any superannuation, investments, or other income sources you may have. Then, subtract these from your retirement number to find out how much more you need to save.

- Factor in inflation: Inflation will erode the value of your money over time, so you’ll need to save more than your current retirement number suggests. Aim to increase your savings rate to adjust for this. A general rule of thumb is to assume 2-3% inflation annually.

The goal is to ensure that when the time comes, you have the freedom and security to enjoy your retirement without worrying about running out of money.

Step 9: Leave a legacy

In the final step, Barefoot encourages the readers to leave a legacy by thinking about how you can pass on wealth to future generations or support causes that matter to you. He emphasises that a legacy doesn’t just mean financial inheritance; it can also include values, lessons, and wisdom.

Barefoot suggests getting your financial affairs in order by having a will, considering estate planning, and ensuring your superannuation is set up to benefit your loved ones. He also highlights the importance of having clear goals for how you want to leave your mark, whether that’s through financial gifts, charitable donations, or personal impact.

Ultimately, this final step is about ensuring you can help others even after you’re gone, creating lasting value for those who follow. Now that is a legacy.

What next?

And there you have it—9 practical, actionable steps that can transform the way you approach your money and your life.

By following these steps, you’re not just improving your financial situation today, you’re setting yourself up for long-term success and peace of mind. Whether you’re tackling debt, saving for a home, or building a retirement nest egg, each step is designed to help you regain control, reduce stress, and ultimately create the kind of life you want to live.

Of course, everyone’s journey is different, and you don’t have to do everything all at once. Start where you are, take small steps, and build momentum. The key is consistency—stick to the plan, and over time, you’ll see the results.

I encourage you to start with one step, make it a habit, and then move on to the next. Financial freedom doesn’t happen overnight, but with a bit of discipline and a clear plan, it’s absolutely achievable.

Remember, this isn’t just about money; it’s about building a foundation for a life that aligns with your values and long-term goals. Whether it’s protecting your family’s future, building wealth, or leaving a lasting legacy, the Barefoot Investor approach is about being intentional with your finances so that you can live a life of freedom, security, and purpose.

So, what’s the next step for you? Maybe it’s making a commitment to becoming a little wealthier each day, setting up your financial infrastructure so you pay zero bank fees, cutting up your credit cards or starting that emergency fund. Whatever it is, take it one step at a time, and you’ll be on the path to a financially secure and fulfilling future.

Closing off with a heart-felt thank you to the author Scott Pape, for putting this and his other books out there to help millions of readers. If you’d like to purchase The Barefoot Investor, Barefoot for Families or Barefoot Kids- you can find everything you need here.

If you found this entry of The Integrated Masculine Man helpful, don’t hesitate to share it with others who might benefit from it. We all have the power to take control of our financial futures—and together, we can create a more financially literate and secure world for ourselves and the generations that follow.

-TIMM

For those who want more!

Barefoot sends a weekly email newsletter on Mondays, covering reader questions, personal updates, and insights into the nation’s financial landscape. Personally, I find it a quick and insightful read that occasionally teaches me something new!

The only time he skips a newsletter is during school holidays or when he’s on an overseas family trip—because if you’re following the Barefoot steps, your financial journey should be on autopilot. So, take full advantage of the one currency you can’t buy more of: time.

To subscribe to his weekly Barefoot newsletter – click here.

Leave a comment